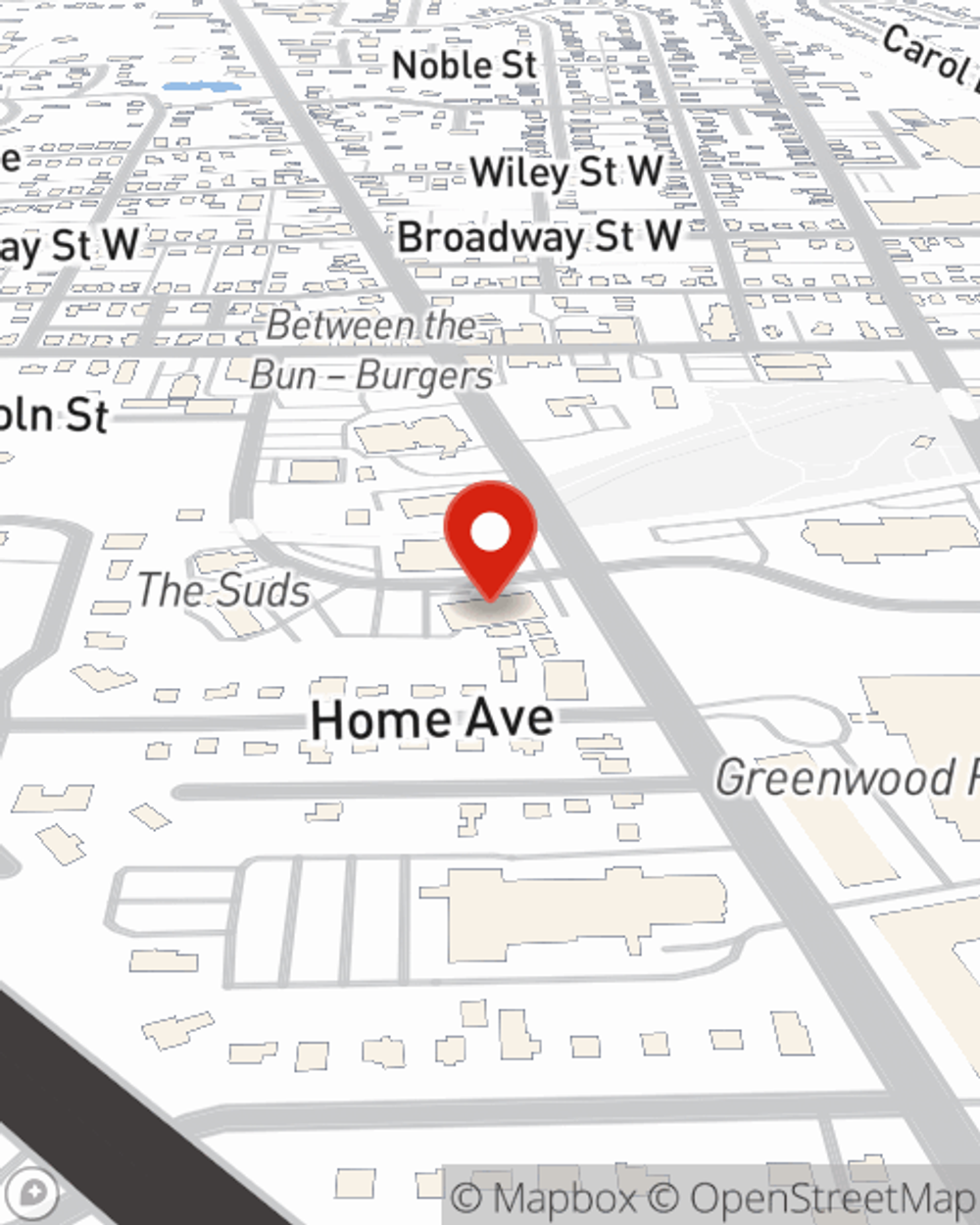

Homeowners Insurance in and around Greenwood

Looking for homeowners insurance in Greenwood?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- greenwood

- franklin

- whiteland

- new whiteland

- bargersville

- trafalgar

- nineveh

- martinsville

- mooresville

- indianapolis

- beech grove

- southport

- shelbyville

- columbus

- nashville

- plainfield

- monrovia

- madison

- hanover

- Johnson County

There’s No Place Like Home

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance protects more than just your home's structure. It protects both your home and your precious belongings. In case of falling trees or a tornado, you might have damage to some of your belongings in addition to damage to the home itself. Without insurance to cover your possessions, you might not be able to replace your valuables. Some of your valuables can be covered if they are lost or damaged outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Looking for homeowners insurance in Greenwood?

The key to great homeowners insurance.

Open The Door To The Right Homeowners Insurance For You

State Farm Agent Brent Shewmaker is ready to help you handle the unexpected with dependable coverage for your home insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Brent Shewmaker can help you submit your claim. Find your home sweet home with State Farm!

Get in touch with State Farm Agent Brent Shewmaker today to check out how a State Farm policy can help protect your house here in Greenwood, IN.

Have More Questions About Homeowners Insurance?

Call Brent at (317) 881-6729 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.

Brent Shewmaker

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.